Understanding tax residence is crucial for individuals to comply with legal requirements and optimize their tax obligations. Tax residence refers to the country or jurisdiction where an individual is considered a resident for tax purposes. This determination can impact tax rates, eligibility for deductions, and overall tax liability. In this blog post, we will explore important aspects of tax residence declaration for individuals, presenting a clear table of contents and detailed explanations of each item.

| Aspect | Description |

|---|---|

| Definition of Tax Residence | The criteria used to determine an individual’s tax residence. |

| Common Criteria | Factors that typically influence tax residency status. |

| Consequences of Residency | How residency affects tax obligations. |

| Non-Residency | Understanding the implications of being a non-resident. |

| Double Taxation Agreements | How treaties can affect tax residence declarations. |

| Changing Residency | Steps to take when changing tax residence. |

| Documenting Residency | What documents are necessary for proof of residency. |

| Local Laws and Regulations | Understanding local tax laws regarding residency. |

| Tax Planning Strategies | Effective strategies for tax planning based on residency. |

| Resources for Assistance | Where to find help with tax residence declarations. |

Definition of Tax Residence

Tax residence is defined by the jurisdiction’s laws and regulations, determining where an individual is liable to pay taxes. Different countries have varied definitions based on factors such as the number of days spent within the country, the location of one’s primary residence, and the individual’s personal and economic ties to the jurisdiction. Understanding these definitions is crucial for individuals to ensure compliance and avoid unnecessary penalties.

Common Criteria

Common criteria that influence tax residency typically include physical presence, permanent home, and center of vital interests. Physical presence often refers to the number of days spent in a country, while a permanent home may refer to the location where an individual has a long-term residence. The center of vital interests considers where an individual’s personal and economic relationships are stronger, influencing their residency status.

Consequences of Residency

The consequences of being classified as a tax resident can be significant. Tax residents are generally required to report and pay taxes on their worldwide income, while non-residents may only be taxed on income sourced from the country of residence. This distinction can lead to different tax rates and obligations, making it essential for individuals to understand their residency status.

Non-Residency

Non-residency status means that an individual is not considered a tax resident in any jurisdiction. This status can provide certain benefits, such as being taxed only on income sourced from that country. However, non-residents may also face higher withholding taxes on certain types of income, and they may not have access to certain tax benefits available to residents. Understanding the implications of non-residency is crucial for effective tax planning.

Double Taxation Agreements

Double taxation agreements (DTAs) are treaties between two or more countries to prevent the same income from being taxed in multiple jurisdictions. These agreements often include provisions that clarify residency status and can significantly affect an individual’s tax obligations. Familiarizing oneself with applicable DTAs is vital for individuals who may be subject to taxation in multiple countries.

Changing Residency

Changing tax residence can involve various steps, including notifying tax authorities, updating residency status in financial institutions, and potentially filing tax returns in both the previous and new jurisdictions. It is essential to understand the tax implications of such changes, including exit taxes and the treatment of capital gains, to avoid complications and ensure compliance with all legal requirements.

Documenting Residency

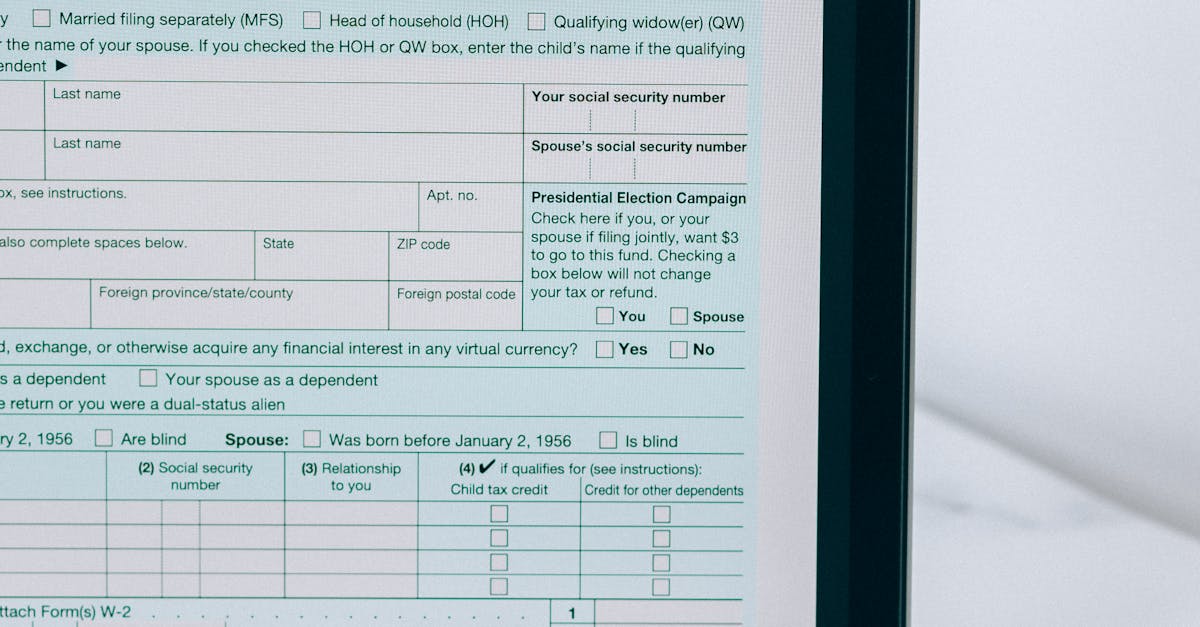

To substantiate residency claims, individuals may need to provide specific documents, such as proof of residence, employment contracts, utility bills, and tax returns. Proper documentation is essential for tax compliance and can help avoid disputes with tax authorities. It is advisable to maintain thorough records of residency-related documents to ensure clarity and compliance in the event of an audit.

Local Laws and Regulations

Each jurisdiction has its own laws and regulations regarding tax residency, which can significantly impact individuals. Understanding local laws is critical for making informed decisions about residency and tax obligations. Consulting with tax professionals familiar with local regulations can provide valuable insights and guidance tailored to individual circumstances.

Tax Planning Strategies

Effective tax planning strategies based on residency can help individuals optimize their tax obligations. This includes taking advantage of available deductions, credits, and exemptions specific to residents or non-residents. Engaging in proactive tax planning can lead to significant savings and ensure compliance with local tax laws.

Resources for Assistance

Individuals seeking assistance with tax residence declarations can turn to various resources, including government tax agencies, tax professionals, and online tax platforms. Many countries provide official guidelines and resources on their tax authority websites, making it easier for individuals to navigate the complexities of tax residency.

FAQs

What factors determine tax residence?

Tax residence is typically determined by factors such as the number of days spent in a country, the location of a permanent home, and the center of vital interests. Each jurisdiction may have specific criteria that must be met to establish residency.

How can I change my tax residency?

Changing tax residency usually involves notifying tax authorities, updating relevant documentation, and understanding the tax implications of the change, including any potential exit taxes.

What is a double taxation agreement?

A double taxation agreement is a treaty between two or more countries that prevents the same income from being taxed in multiple jurisdictions, often clarifying residency status and tax obligations.

Where can I find help with tax residency issues?

Individuals can find assistance through government tax agencies, tax professionals, and online tax resources. Many jurisdictions provide official guidelines on their tax authority websites.

References:

– [IRS – Tax Guide for Individuals](https://www.irs.gov)

– [HM Revenue & Customs – Residence](https://www.gov.uk/government/organisations/hm-revenue-customs)

– [OECD – Model Tax Convention](https://www.oecd.org/tax/model-tax-convention-on-income-and-on-capital-9789264239081-en.htm)