Navigating income tax filing can be overwhelming, especially for seniors. Fortunately, Canada offers various options for seniors to file their income taxes without incurring any costs. This article will guide you through these options, providing clear and concise information to help you make the best choice for your situation.

| Option | Description |

|---|---|

| NETFILE | Online filing for eligible seniors using approved software. |

| Community Volunteer Income Tax Program (CVITP) | Free tax preparation services provided by volunteers. |

| Paper Filing | Submitting your tax return via traditional mail. |

| Tax Clinics | Local organizations offering free tax preparation assistance. |

| Online Resources | Government websites providing guidelines and tools for filing. |

NETFILE

NETFILE is a secure online service that allows seniors to file their income tax returns directly to the Canada Revenue Agency (CRA) using approved tax software. Many software options are available for free or at a low cost for seniors, making it an accessible choice for those comfortable with technology. By using NETFILE, seniors can enjoy a faster processing time and quicker refunds, which is especially beneficial for those who rely on their tax return for additional income.

Community Volunteer Income Tax Program (CVITP)

The Community Volunteer Income Tax Program (CVITP) is an initiative that offers free tax preparation services to eligible individuals, including seniors, through trained volunteers. This program operates in various community organizations, libraries, and senior centers across Canada. Volunteers help seniors understand their tax obligations and ensure they receive all applicable credits and benefits. This option is ideal for seniors who prefer in-person assistance and may need help navigating the complexities of tax filing.

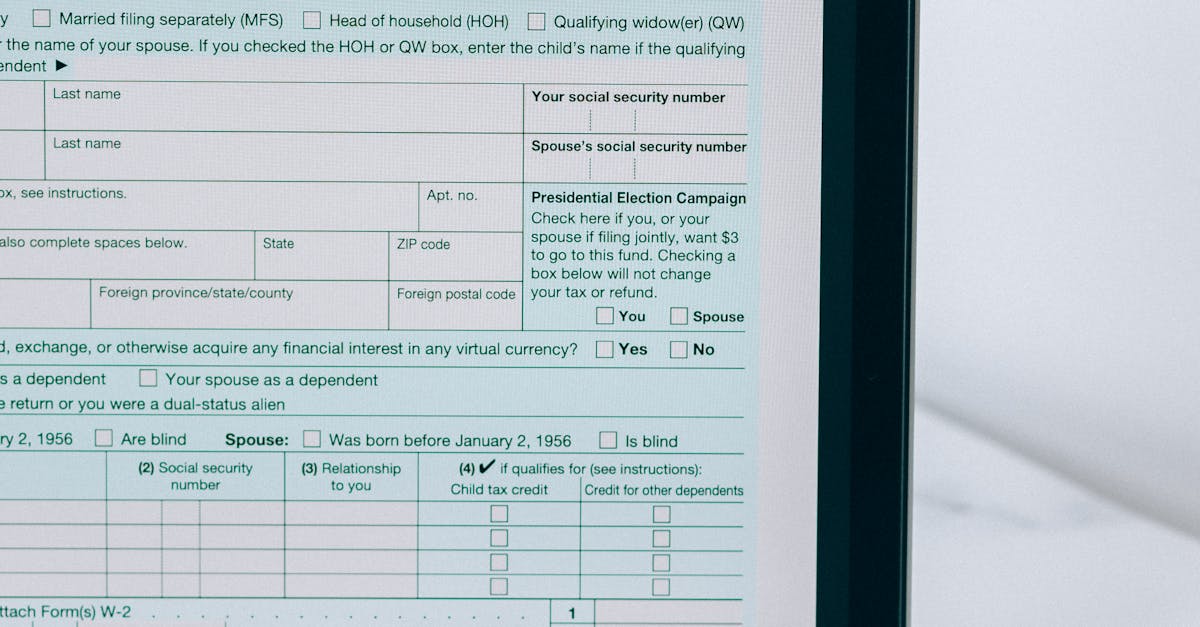

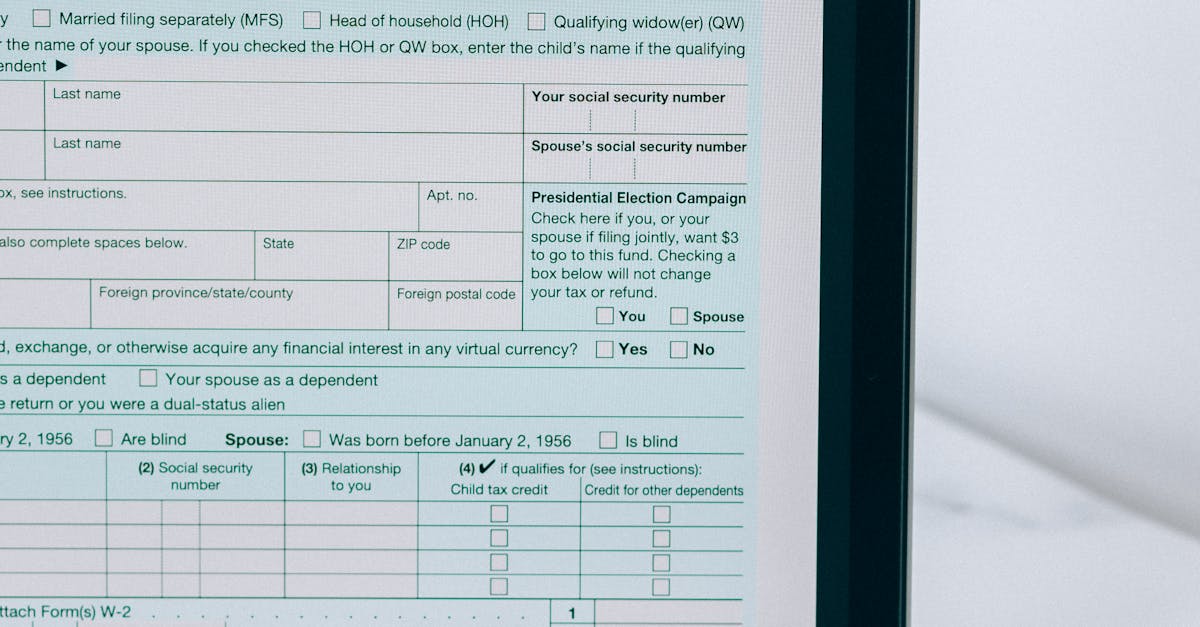

Paper Filing

For seniors who prefer traditional methods, paper filing remains an option. This involves completing a paper tax return and mailing it to the CRA. While this method may take longer for processing and refunds, it allows seniors to take their time and ensure they understand each section of the tax return. The CRA provides paper forms that can be requested online or by phone, and seniors can also access guides to help them through the process.

Tax Clinics

Many local organizations and community centers offer free tax clinics during tax season. These clinics are staffed by volunteers or professionals who assist seniors with their tax returns. They can provide valuable advice on maximizing deductions and credits, ensuring that seniors receive the full benefits they are entitled to. Tax clinics are particularly helpful for seniors with more complex tax situations or those who have not filed in several years.

Online Resources

The Government of Canada offers a wealth of online resources to assist seniors with income tax filing. The CRA website contains comprehensive information on tax credits, deductions, and guidelines for filing. Seniors can access calculators to estimate their taxes, as well as detailed guides that walk them through each step of the process. Utilizing these resources can empower seniors to file their taxes confidently and accurately, whether they choose to do it themselves or seek assistance.

FAQs

What is the deadline for filing income tax returns in Canada for seniors?

The deadline for most Canadians, including seniors, to file their income tax returns is April 30. However, if you or your spouse/common-law partner is self-employed, the deadline is June 15, though any taxes owed must still be paid by April 30 to avoid interest charges.

Can seniors claim any additional tax credits?

Yes, seniors may qualify for various tax credits, such as the Age Credit, Pension Income Credit, and Disability Tax Credit. These credits can significantly reduce the amount of tax owed and increase potential refunds.

Is it necessary for seniors to file taxes if their income is low?

While it may not be mandatory for seniors with low income to file a tax return, it is often beneficial to do so. Filing can ensure that they receive any potential benefits or credits, such as the Goods and Services Tax (GST) credit or the Canada Child Benefit (CCB), if applicable.

What documents do seniors need to file their taxes?

Seniors should gather documents such as their T4 slips (employment income), T5 slips (investment income), pension statements, and receipts for any deductions or credits they plan to claim. Having these documents organized will streamline the filing process.

Where can seniors find assistance for tax filing?

Seniors can find assistance through the Community Volunteer Income Tax Program (CVITP), local tax clinics, and online resources provided by the CRA. Many community centers also offer workshops and help sessions for seniors during tax season.

References:

1. [Canada Revenue Agency – Seniors](https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/individuals/seniors.html)

2. [Community Volunteer Income Tax Program](https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/volunteer-income-tax-program.html)

3. [Filing Your Income Tax Return](https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/filing-return.html)